Many People Seem Very Invested in Pretending That What's Happening Isn't Happening

Vanguard, manager of some of my retirement funds, offered in a mass email this week to give me a look ahead, a teaser, a foretaste, if you will, of the "key financial and economic trends that are likely to shape the market in 2026."

Rather than delete it as I normally would with the rest of the daily unsolicited junk mail, I followed the links because I was legitimately curious what a giant financial firm had to tell me about 2026, which while only about three weeks old, feels like it's already lasted about three months, what with all of the daily wars—actual, trade and otherwise—and other general chaos.

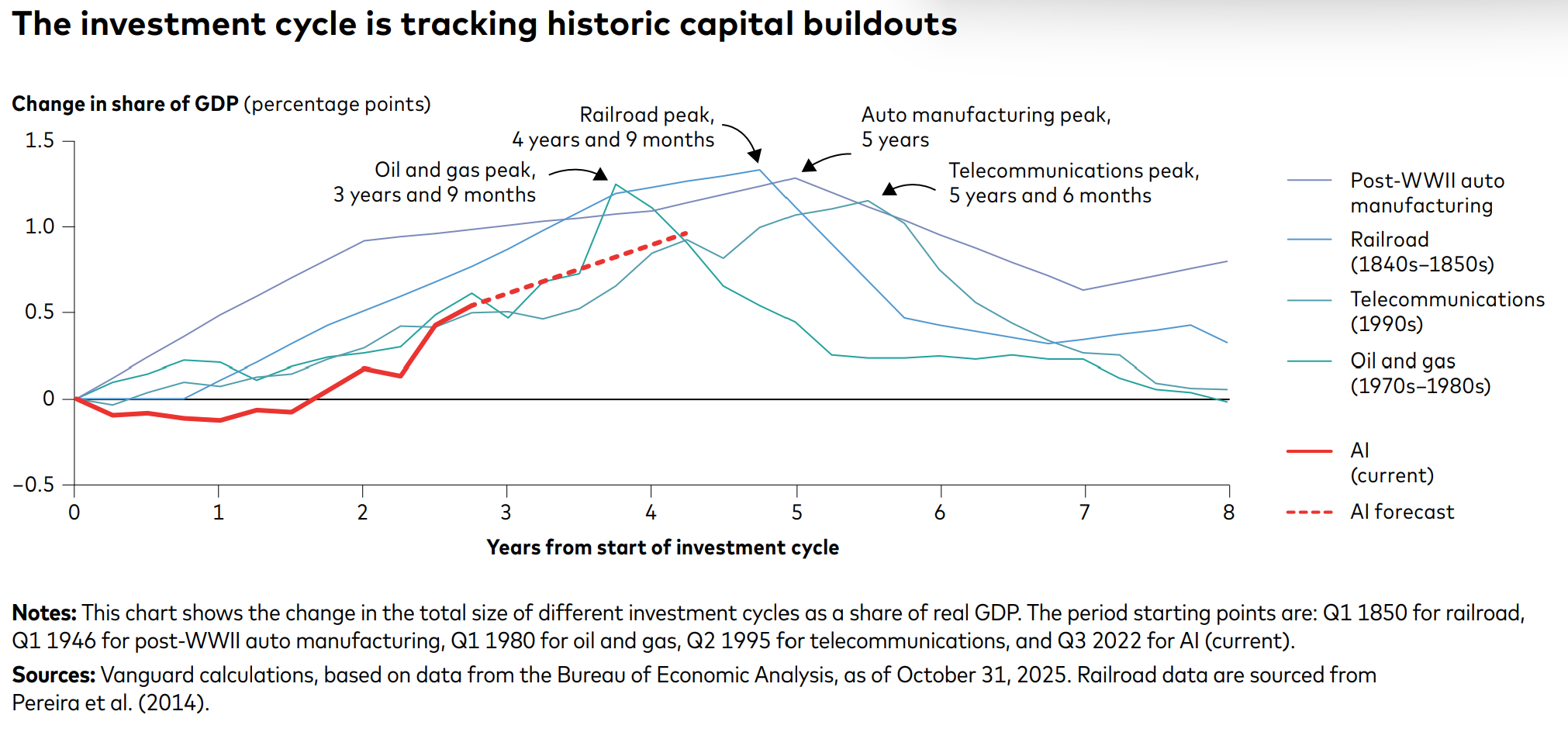

What I learned is that none of that chaos is factoring into Vanguard's 2026 analysis, or at least not the analysis that it chooses to share with the general public. There are a report and videos, pretty much all of it focused on AI. As an AI skeptic who worries at times about basing my skepticism on hunches and vibes, I appreciated the analysis, including this chart:

What Vanguard is postulating is that we're still in the early stages of the AI capital investment boom, and that the economy will continue to grow at a healthy clip as the AI buildout continues. That presumes, of course, that AI's investment cycle plays out similarly to those of other technologies that have proven tremendously useful to American society, such as automobiles and oil and gas.

I'm not sold on that. I'm more of an Ed Zitron guy, and if you don't know him and are in the AI-averse camp, I highly suggest you check him out. Zitron is skeptical of the technology itself, as well as the financial hijinks that increasingly seem to be the engine keeping the growth story going. Vanguard nods at the possibility that "the market may be underpricing the potential for forthcoming AI capital investment to underdeliver," and also that big AI firms will increasingly "become astute operators of their funding capacities, likely utilizing most (if not all) available channels to maintain their earnings growth trajectories," which is all finance-speak for the possibility that demand for AI doesn't warrant all of the billions being poured into it, leading firms to be aggressive with their bookkeeping to make it look like the reverse is true. And that, of course, is just a fancy way of describing a bubble being inflated and then eventually doing what all bubbles do. Who knows? I, for one, do not, but my money (if I were a betting man, which I am not) would be on an AI-related recession, and sooner rather than later.

All of that aside, what really struck me about the report was the absence of any mention of any of the other bullshit of Trump II.

How does the forecast change if we're at war with Europe? What if a loon is appointed chair of the Federal Reserve? How about now that we've left the World Health Organization and gutted scientific and medical research and encouraged the spread of measles and turned the Department of Justice into Trump's personal retribution force and allowed government corruption on an intergalactic scale and sicced a paramilitary force on our cities?

What do the fine analysts at Vanguard think about those things? Because the bill for those things is very much unpaid and getting larger by the day and will require repayment no matter what we may want. Maybe it's not in their 2026 forecast because they know that the damage that’s been done is the sort of thing that will require repayment over a generation. One year isn't nearly enough and anyway we can keep coasting on our fumes a while longer.

I imagine those analysts, just like a lot of the rest of us, don't want to think about that bill because thinking about that bill would require us to conclude that a lot of things that we think about our economy and our country and ourselves are not actually true. So I guess we're just going to keep pretending that nothing has changed and hope that no one cares that everything has.